What is MACRS Depreciation?

MACRS, which stands for Modified Accelerated Cost Recovery System, is a depreciation method used in the United States to recover the cost of tangible assets, including solar panel systems. It allows businesses and individuals to recover the costs of their investments over a fixed period through annual depreciation deductions.

Understanding the Benefits of MACRS for Solar Panels

MACRS Depreciation offers significant benefits for solar panel owners. By depreciating the cost of your solar panel system over several years, you can reduce your taxable income and lower your overall tax liability. This tax incentive helps make the transition to solar energy more affordable and encourages businesses and individuals to invest in renewable energy.

How MACRS Depreciation Works for Solar Panel Systems

When you install a solar panel system, it is classified as a five-year property under MACRS. This means you can recover the cost of your solar panels over a five-year period through depreciation deductions. The depreciation is accelerated, meaning you can deduct a larger portion of the cost in the earlier years, resulting in more significant tax savings.

Qualifying for MACRS Depreciation: Requirements and Guidelines

To qualify for MACRS Depreciation, your solar panel system must meet certain requirements. The system must be used for business or income-producing purposes and meet the specifications outlined by the IRS. Additionally, the solar panels must be in use before the end of the tax year to be eligible for depreciation.

Calculating MACRS Depreciation for Your Solar Panel Investment

Calculating MACRS Depreciation for your solar panel investment involves understanding the applicable recovery period, the depreciation method, and the cost basis of your system. The IRS provides tables and guidelines to assist with the calculation, and it’s essential to consult a tax professional to ensure accuracy.

Comparing MACRS to Other Solar Incentives: Why MACRS Matters

While there are various solar incentives available, MACRS Depreciation offers distinct advantages. Unlike tax credits, which reduce your tax liability dollar-for-dollar, MACRS Depreciation provides ongoing annual deductions, resulting in long-term tax savings. Understanding the differences between these incentives can help you make informed decisions about financing your solar panel investment.

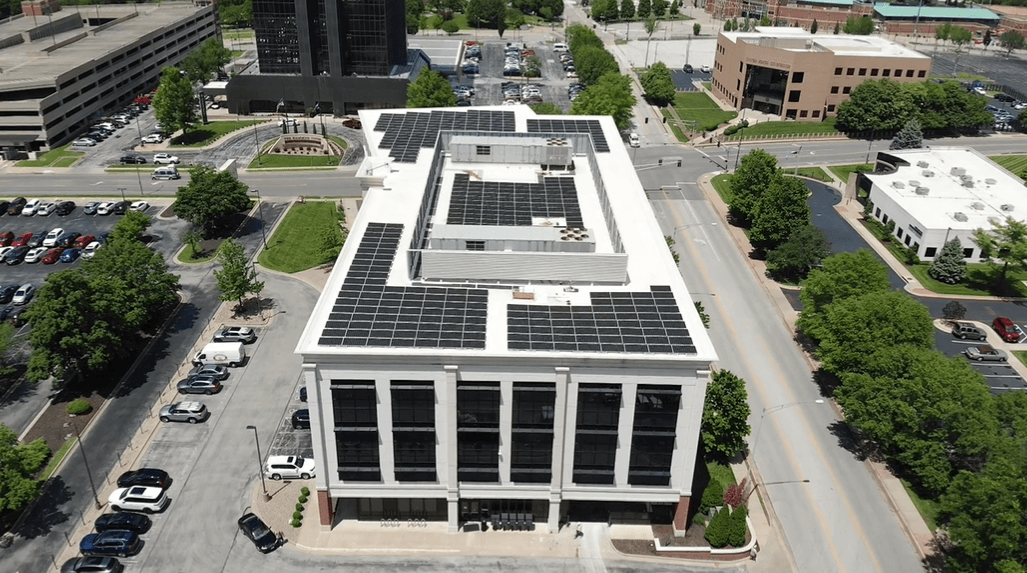

APC Walks You Through The Process

When choosing APC Solar, we help you plan and prepare everything your accountant will need to help you claim the MACRS.

Contact Us Today